Sanwo Olu Increases Minimum Wage to N70,000 for Lagos Workers

Governor Babajide Sanwo-Olu has declared a doubling of the minimum salary in a major step to improve the wellbeing of…

Nigeria Stops Training of Pharmaceutical Technologists

A Memorandum of Understanding (MoU) was signed on Wednesday by the Pharmacy Council of Nigeria (PCN) and the National Board…

FG to Review Entry Age for University Students

The federal government intends to examine and set the minimum enrollment age for higher education institutions of learning in the…

FCCPC Storms Chinese Supermarket Over Discrimination Policy

Authorities from the Federal Competition and Consumer Protection Commission (FCCPC) have closed a Chinese supermarket located in the China General…

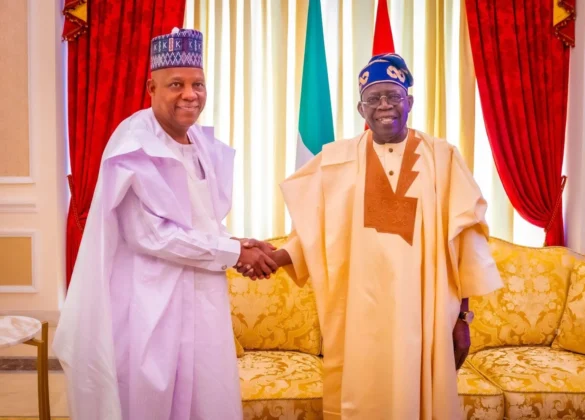

‘Nigeria Will Become Major Global Economy Under Tinubu’ – Shettima

Vice President Kashim Shettima is confident that President Bola Tinubu will make Nigeria a significant economic force in the world. …

Nigerian Chess Genius Begins 58-Hour Guinness World Record Attempt at Times Square

Nigerian Chess Master, Tunde Onakoya, attempts to break the Guinness World Record for playing Chess without losing a single round….

Dangote Reduces Diesel Price to 1000 per Litre

The Dangote Petroleum Refinery has announced a reduction in the price of diesel from 1,200 Naira to 1,000 naira per…

TInubu Declares April 7 as National Police Day

President Tinubu, represented by Vice President Kashim Shettima, made this known on Monday night during the maiden edition of the…

A Decade After Tragedy: Reflecting on the Aftermath of the Chibok Girls Kidnapping

Ten years have passed since 276 girls were abducted from their school in Chibok, Borno state, Nigeria. This event led…

Meet Nigerian Professor Omowunmi Sadik, who Invented Explosive-Detection in US

A United States-based Nigerian female professor, Omowunmi Sadik, invented microelectrode biosensors for the detection of drugs and explosives. Sadik has…

Reviews

Follow Our Activities On Facebook

4 hours ago

4 hours ago

4 hours ago

7 hours ago

1 day ago

SUBSCRIBE

[mc4wp_form id=”2012″]

Top Reads!

#BigBrotherNaija “Level Up” Week 6

Though last Sunday Sunday was meant to be a “no-eviction” day, it came as a shocker when fake housemate, Modella…

Dating in 2022; Situationships Are Not For The Fainthearted

Situationships are defined as that space between a defined relationship and something other than a friendship. It is a romantic…

20 Questions With Dinta Media’s Visual Storyteller, Chimeremogo Nwoke

Dinta Media is not really just a media production brand but we like to see ourselves as a hub for…

How Are Nigeria’s Small Businesses Coping?

The current rising rate of inflation and other burdens against the Nigerian economy speaks to the realities of the times.

Thrifting Is All The Rave Now, Here’s Why

By Amy Adindu The affordable clothing movement has gained global attention and acceptance as we’re all trying to look like…

#BigBrotherNaija “Level Up” Week 2

Week 2 of the highly watched Nigerian TV show kicked off with an early plot twist. On Sunday, Big Brother…

#BlueTunes: Burna Boy, Omah Lay Top Album Picks For July

July was a promising month for music lovers; from Lizzo’s album titled Special and Imagine Dragons’ Mercury, (Acts 1 &…

#BlueTunes Album Picks For June

Gbagada Express – Boj Bolaji Odojukan, popularly known as BOJ, was raised both in England and Nigeria. He shot to…

“A Creative’s Dream” with Jeff Chinonso

On the 26th of June 2022, Jeff Chinonso hosted his first solo art exhibition. The Augmented Reality exhibition themed “A…

Nigerian API-based company Thepeer raises $2.1 million

Tech infrastructure startup Thepeer has raised a $2.1 million seed round according to a report from TechCabal. Thepeer, a Nigerian…

Dika Ofoma, Ugochukwu Onuoha take on grief in Debut Film “The Way Things Happen”

The twenty-minute film focuses on the loss of a loved one, and how grief changes a person.

Nigerian Startups might just be Crippled by a Recently Leaked bill

Over the years there has been talks of amendment on the 2007 Act of the National Information & Technology Agency (NITDA).

Why We Love Kelechi Amadi Obi

The definition of talent is Kelechi Amadi’s iconic story. Imagine a person who studies law in school, gets called to Bar, and leaves it all for something different and unrelated…Painting!

Stay Connected